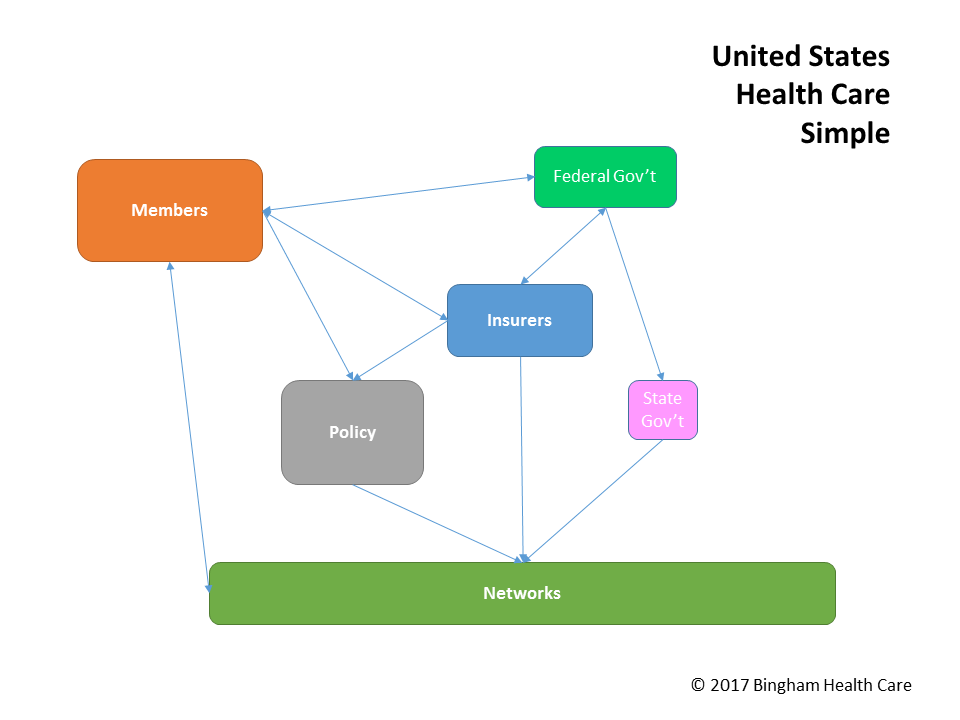

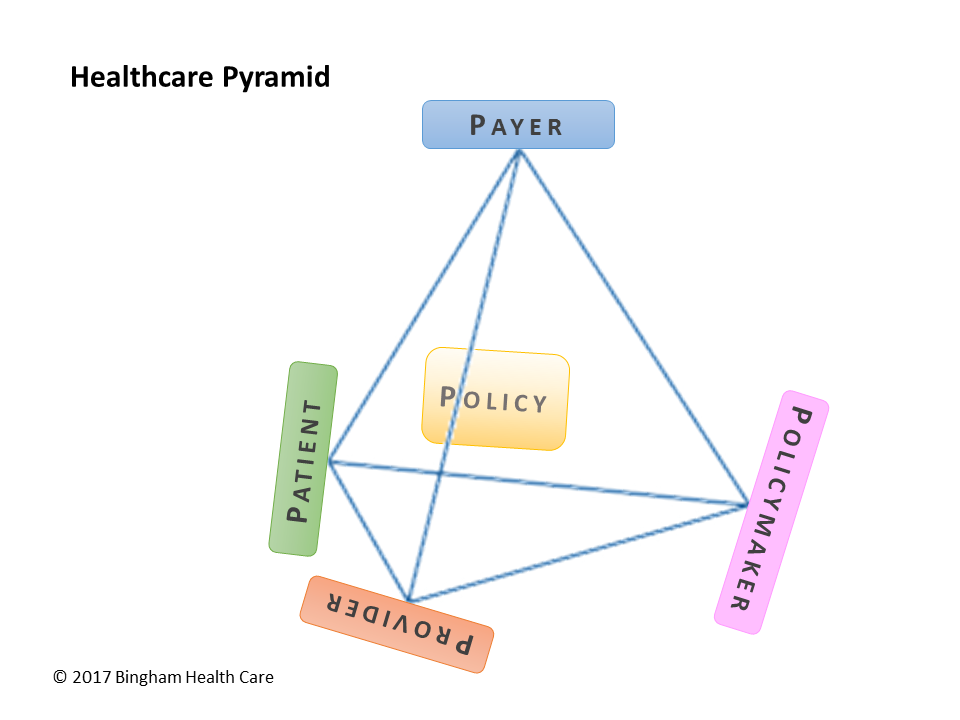

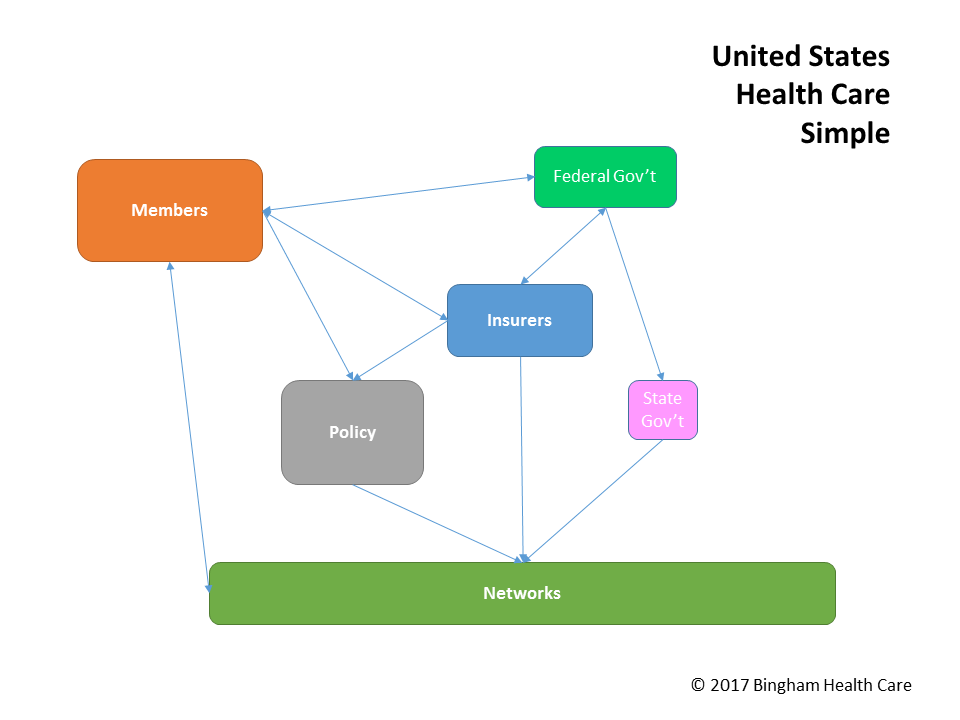

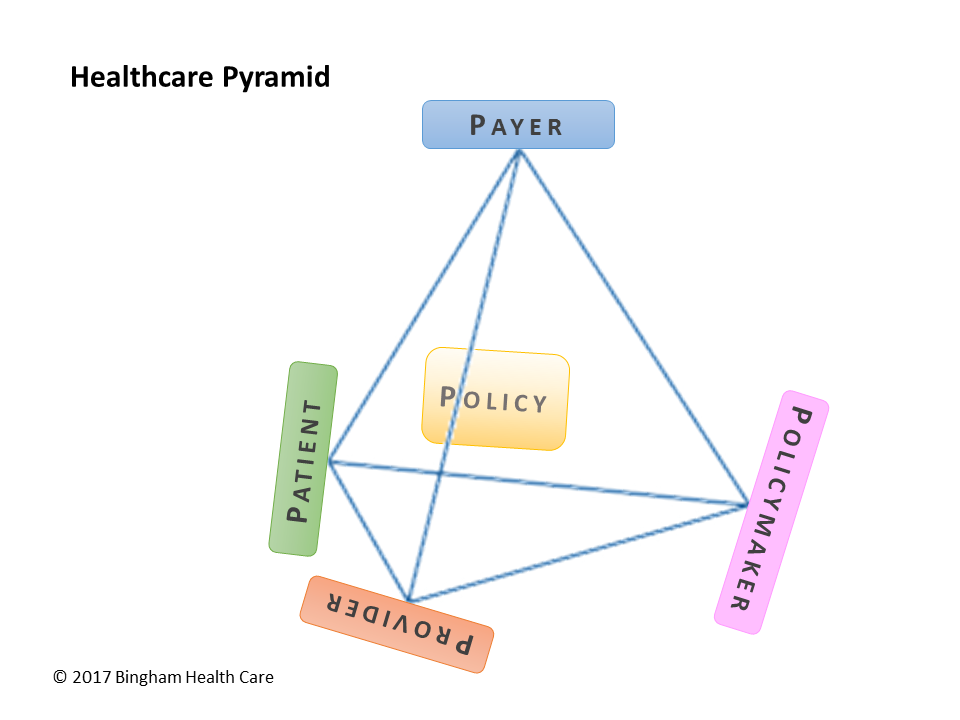

At its core, the healthcare system in the United States involves members/patients, insurance companies/payers, healthcare policies, and provider networks, all regulated by state &/or federal regulators – the healthcare pyramid. The following describes common practices in the individual and family market, as regulated by the Affordable Care Act (ACA).

An insurance company will develop a policy containing benefits, such as emergency room coverage, specific pharmaceuticals, and hearing aids, to name but a few. This policy explains where and how members can avail of these benefits, along with coverage restrictions. In order for a member to obtain a particular benefit, the member usually goes to a healthcare provider, such as a doctor, hospital, or pharmacy. In putting together the policy, the insurance company will coordinate with providers, negotiating rates, quality expectations, and other relevant factors for a specific member experience.

Once approved by regulators, the insurance company can sell this policy to eligible buyers. The purchaser and/or her family would become policy member(s), able to take advantage of the policy's benefits. The members could then go to providers in the network to receive covered benefits.

The insurance company sells the policy, charging the member/policyholder a certain amount every month. This is known as the premium. When the member goes to a provider for service, the provider charges a certain amount for that service. The way health insurance works is that the provider will be paid by the insurance company, or by the member, or both, depending on the terms of the policy/contract.

Let's walk through an example scenario to explain healthcare's financial aspects. Assume the member is a single adult who falls and breaks his leg. Before breaking his leg, the person contacts the insurance company and buys a policy for $500 per month, paying each month in advance, before the month begins.

Sometime during the year, with the premium payments current and the coverage in effect, the member falls off a ladder while clearing the roof gutter. This fall causes a broken leg. The member could go to an emergency room, but decides to tough it out and instead goes in to see his primary care physician, or PCP. The PCP examines the member's leg and orders an x-ray, for evaluation. The member hobbles to the imaging department or center and gets an x-ray of his leg. In addition, the PCP authorizes and orders a pair of crutches for the member, which the member picks up at a healthcare supply store. To help with the pain, the PCP prescribes prescription-strength pain medication; the member picks up this medication at a local pharmacy.

Based on the policy in this example, the PCP's charge is fully covered by the insurance company, so the member does not have to pay anything "out of pocket" for seeing his PCP. The PCP normally charges $100 for the visit, but rate negotiated with the insurance company is only $80. In this case, the provider might submit a bill for $100 (the billed amount), but the insurance company will pay only $80 (the allowed amount), based on the fee schedule.

When the member gets his x-ray, the imaging center charges $150 for the x-ray. Here is where it starts to get a bit complex. Assume the member's policy has a 40% coinsurance for x-rays, and that it is not subject to a deductible. This means that the insurance company would pay 60%, or $90, and the member is responsible for the 40%, or $60. Just as with the PCP, the imaging center would bill the insurance company in order to be paid the $90. Separately, either at the time the member is in for the x-ray, or billed later (for instance, by sending a bill/invoice in to the member in the mail), the member pays $60.

Now, when we get to the crutches, we throw another wrinkle into the mix. Specifically, crutches are a covered benefit under the policy, but they are subject to a deductible. Let's say the policy has a $1500 deductible, applicable to benefits including crutches. Further, suppose the benefit for crutches includes a $50 copayment, or copay. Taking these two separately, suppose the supply company charges $200 for the pair of crutches. The insurance company will not pay anything unless and until the member has satisfied the deductible. Whenever the member obtains benefits under the policy, and for those benefits that are subject to the deductible, the member must pay the full amount of those benefits, with those payments going toward the deductible. After that, the insurance company will pay for the benefit, in whole or in part, as per the terms of the policy.

Let's say that the member has not yet reached his deductible. In this case, the member would pay the entire $200 for the the crutches; that $200 accumulates toward the deductible amount, so that the next time the member obtains a benefit that is subject to the deductible, the member would not have to pay the entire amount fot that benefit, if the deductible has been paid by then. Now let's instead look at the case where the member goes in for the crutches and has already met his deductible. Then, from the policy terms, the member would be responsible for $50, which the member would pay to the supply store, and the store would then bill the insurance company for the remainder, $150. To determine how much the member pays and how much the insurance company would pay, the store can contact the insurance company before selling the crutches.

The member then wants to fill the pain medication prescription. He goes to a national pharmacy chain and either presents a written prescription from his PCP, or, if the doctor sent the prescription directly to the pharmacy, the prescription should be ready when the member arrives. Similar to other benefits, drugs might be subject to a deductible, which could be the same deductible as for other benefits or it might be a separate deductible, specifically for Rx benefits. In our example, the pain medication costs $75, and with a 50% coinsurance, the member has to pay $37.50 (the insurance company pays the other $37.50 to the pharmacy). However, the member remembers that this 50% coinsurance is the case for name brand drugs, but that generic drugs incur only a $10 copay. Wanting the keep costs down, the member calls the PCP's office and has the doctor change the prescription to the generic version of the pain medication. The pharmacy charges only $50 for the generic version. The member pays the pharmacy the $10 copay and walks out with his pain meds. The pharmacy then bills the insurance company for the remaining $40.

Another concept that complicates coverage is an out-of-pocket maximum (OOPM), or maximum out-of-pocket (MOOP). Once the member has paid this amount for covered benefits, though copays and coinsurance payments, the insurance company then would cover policy benefits at 100%. So let's say that the member reached his MOOP when paying his $50 crutch copay. Then, when the member goes in for his prescription, he would not have to pay any coinsurance or copayment. The insurance company would pick up the full cost of the covered prescription drug.

Before we leave the financials, there is an additional concept to consider: subsidized coverage. Most often this means that the government subsidizes on behalf of the member, in effect paying a portion (or all) of the member's responsibility. This can be helping the member with premium payments, or offsetting copays and coinsurance when the member receives care. In the case of premium subsidies, the government pays directly to the insurance company (an example of this is advanced premium tax credit, or APTC, under the ACA), reducing the amount the insurance company expects/collects from the member. In the case of subsidizing the cost of care, the government can pay to the insurance company (as with ACA cost-sharing reduction subsidies, or CSR payments), or pays providers a pre-determined amount (as in the case of Medicare and Medicaid).

One way of thinking about premiums vs. time-of-service is that premiums are paid whether health care is obtained, or not, or how much it costs, just for the privilege of being able to get reduced-cost care, whereas time-of-service payments add up only if covered care is actually given to or for the member. The former is paid regularly, and the latter is paid as needed / as care is obtained.

To summarize, then, in our example scenario, the member pays $500 every month to the insurance company. When the member broke his leg and got servcies and products that were part of his covered benefits, the following payments occurred:

It should be noted that if the member received a non-covered benefit, the entire amount would be his responsibility. If the member went to a provider that was not in the policy's network, if the policy were a health-maintenance organization (HMO) or exclusive-provider organization (EPO) plan type (without referral), then similarly the member would be responsible for the entire cost of the service. If the policy is a preferred-provider organization (PPO), then the member can go "out of network" for benefits that are covered by the policy, and the insurance company may pay some or all of the cost.

An important distinction to note is that a person purchasing a health insurance policy obtains coverage (the policy represents healthcare coverage), and when that person goes to a provider or otherwise receives a covered benefit, she is receiving care (this is health care). Although subtle, coverage and care are often confused; keeping them straight allows for understanding a sticky difference often missed in discussing healthcare.

This scenario is just the tip of the healthcare iceberg, a very simplified view of healthcare in practice. Please contact us for help optimizing your business operations, and obtaining or maintaining a competitive advantage.