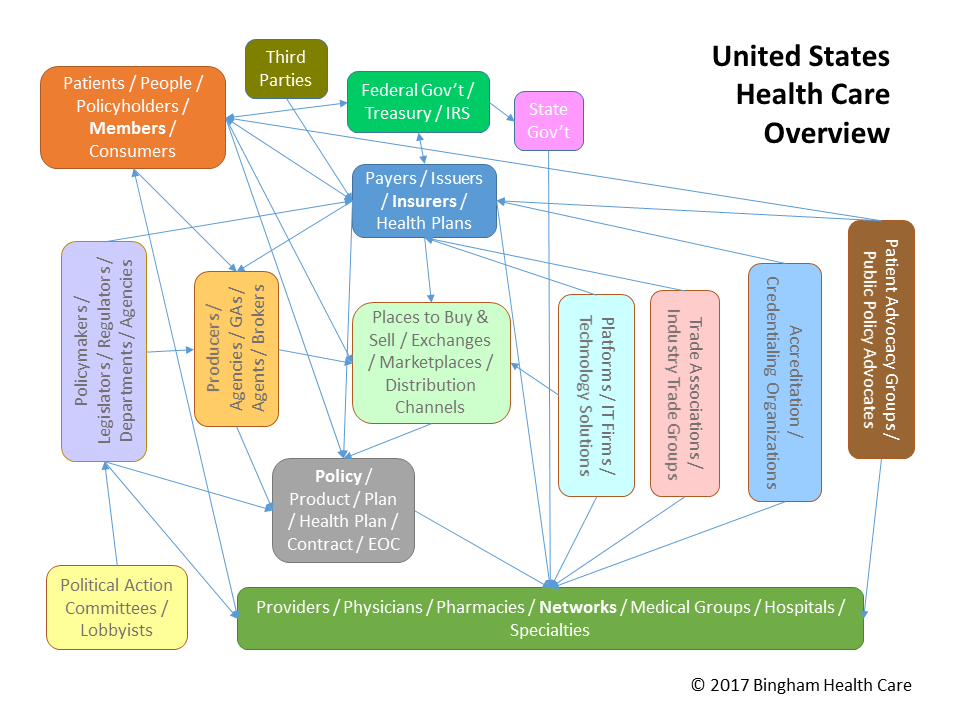

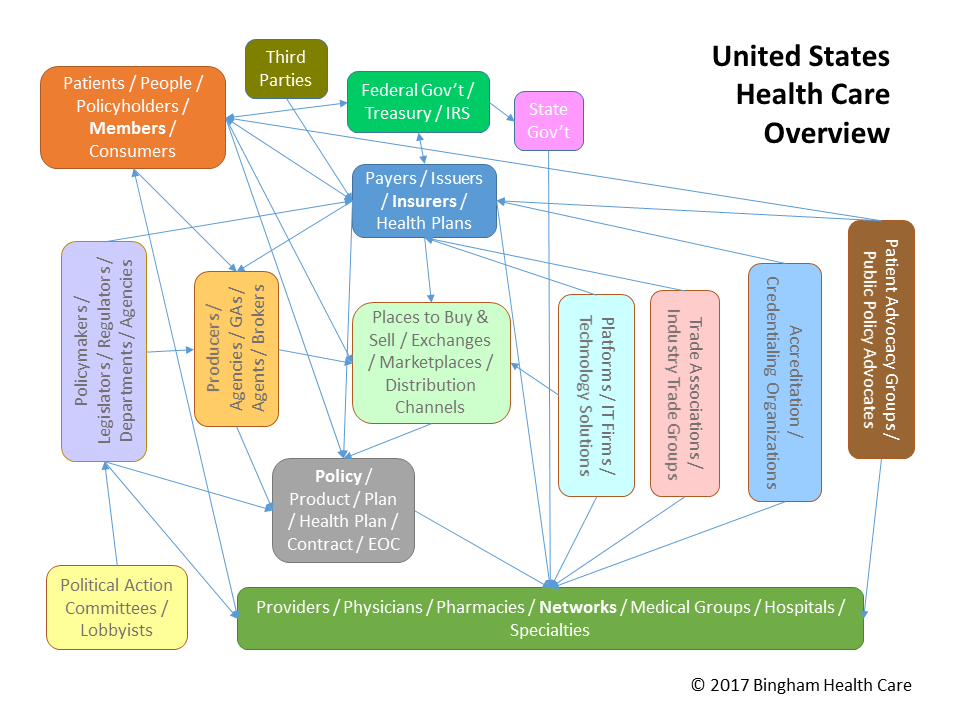

In addition to this overview, elsewhere on BinghamHealthCare.com we discuss important connections among healthcare entities, and walk through an example scenario, as well as delve into costs associated with the healthcare industry. And for a deeper dive into the ACA, please review our ACA whitepaper. See also a list of healthcare-related terms. Additionally, you can learn about Bingham Health Care and see some of our service offerings.

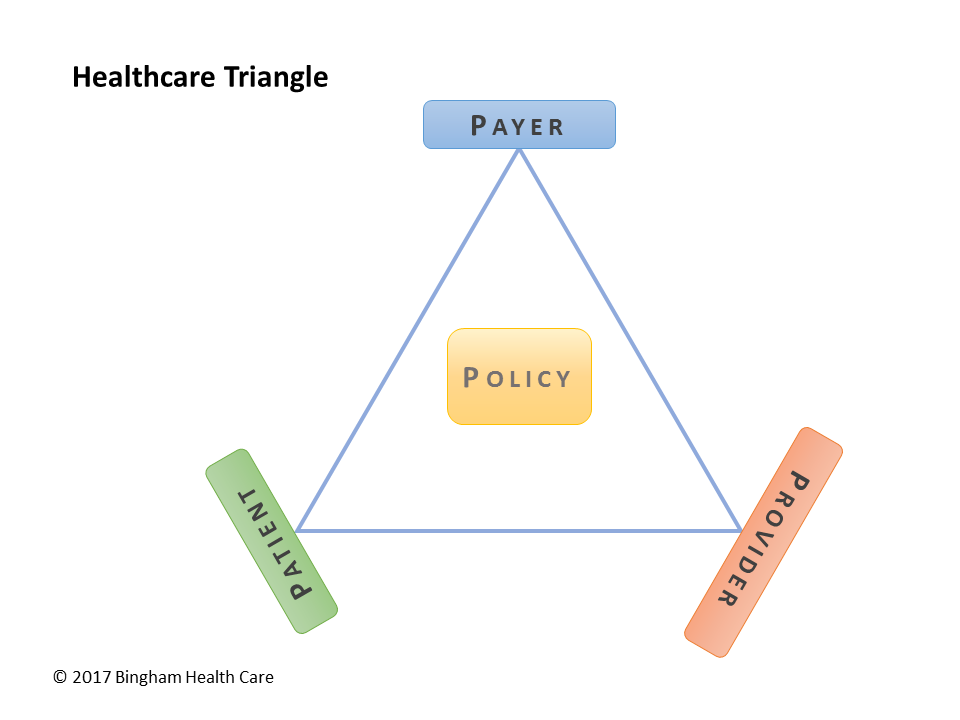

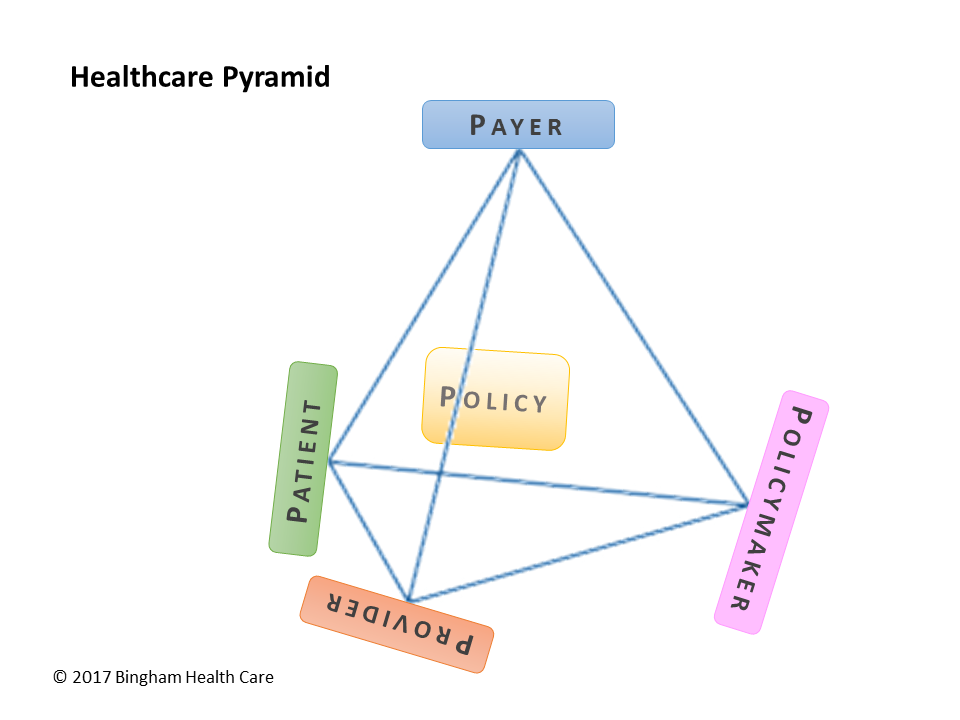

To help conceptualize key healthcare concepts, consider the following healthcare triangle and healthcare pyramid diagrams:

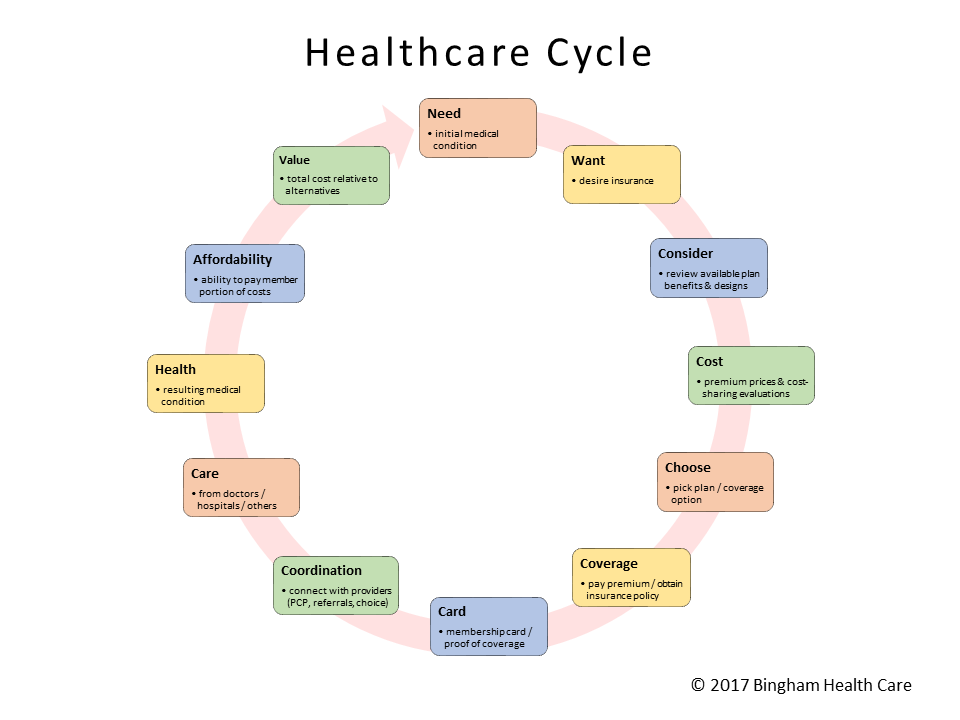

Also, here is a typical healthcare cycle depicting an individual's experiences & decisions:

Healthcare in the United States provides healthcare coverage to individuals, families, employees, veterans, the elderly, low income, and those with disabilities, among other demographics. While the experience is similar for most of these groups, the processes, requirements, regulations, and experiences vary, depending on the market and which entities are involved.

Also, while there are federal healthcare laws, including the Affordable Care Act (ACA), and federal regulators, such as the Department of Health and Human Services (HHS) and its principal agency, the Centers for Medicare and Medicaid Services (CMS), healthcare is mostly state regulated. For this reason, people in different states experience healthcare somewhat differently, although there is substantial similarity across most states.

Here are some of the healthcare markets available to those who meet eligibility requirements:

| Markets | Typical People Served |

|---|---|

| Individual, and Individual & Family (52 million – 16.3%) | individuals, couples, and families |

| Group, including small, medium, large, & custom employer groups (177.5 million – 55.7%) | company employees and their families |

| TRICARE | active duty military personnel and their families |

| Veterans Health Administration (VHA) (15 million – 4.7%) | former military personnel (not dishonorably discharged) |

| Medicare (52 million – 16.3%) | elderly |

| Medicaid (62.4 million – 19.6%) | low income and people with qualifying disabilities |

| CHIP (Children's Health Insurance Program) | low income children |

A distinction we should make at the outset is between healthcare "coverage" and health "care". These terms are often confusing, confused, and conflated. Coverage is obtained when a person is named as a member on a policy, and can obtain care as allowed by the policy. Care, on the other hand, includes covered benefits a member recieves under the policy, such as getting eyes checked, treatment at a skilled nursing facility (SNF), or consults with a registered dietician. Coverage is the option of being able to obtain care, with some or all of the cost of the care being paid by other than the member, as per the coverage policy, whereas care is the actual healthcare service, product, or other covered benefit that is delivered to or for the member/patient under the policy. Insurance companies provide the coverage, healthcare providers provide the care.

Another distinction when discussing healthcare is access vs. ability vs. actual, as they relate to coverage and to care. What this gets to is that someone might have access to coverage (i.e., they qualify for the coverage) but are not able to obtain the coverage (e.g., they might not be able to afford it), and similarly, even if they are able to obtain the coverage, they might not be getting the actual coveage (maybe they don't know where to go or how to fill out the application, or they just choose to not get the coverage). Care has the same distinctions: someone might not have access to care (is it not a benefit in their policy), or that person might not be able to get the care (is the member's share of cost too high), or the patient might not actually get the care (if they are afraid of the test results, for instance).

Of course other scenarios also apply: for instance, a provider might be in the policy's network (and thus the policyholder has access to the care), and/or they might be able to get the care (if they really wanted to), but they might or might not actually be getting the care that they have access to and are able to receive. Another example to help understand these concepts is that one may have actual coverage (i.e., they have a healthcare policy), but they do not have the ability to get care (e.g., the policy's deductible is so high that the person cannot afford provided benefits).

While we think of healthcare as insurance, much healthcare coverage in the United States today is actually not insurance, in a strict sense. Insurance hedges against risks of financial loss, or damage, illness, & death, providing compensation in the event such an undesirable result occurs. It is reactive, providing benefits only in response to a negative occurrence. Healthcare insurance does help when members get sick, providing appropriate care, but it also is used for preventive, wellness, and select elective services, to improve quality of life and help avoid injury or illness.

Relatedly, many "health insurance" policies fall under state insurance laws and regulations, but many others fall under non-insurance laws and regulations. For instance, in California, health insurance policies, such as many PPO plans, fall under the California Insurance Code laws and are regulated by the California Department of Insurance (CDI) & Title 10 of the California Code of Regulations (CCR). Conversely, California health care policies like HMO plans fall under the Knox-Keene Health Care Service Plan Act of 1975 and are regulated by the Department of Managed Health Care (DMHC) & Title 28 of the California Code of Regulations (CCR). From a member's perspective, practically, there is little difference, but for those providing healthcare coverage and care (insurance companies and providers), the rules, regulations, policies, practices, processes, and procedures can vary depending on which specific laws, regulations, and regulators govern their businesses.

On this site, we refer to health insurance policies or benefit plans, and to health insurance companies or healthcare issuers or payers, while the policies are also known as plans, health plans, products, contracts, EOCs, evidences of coverage, and coverage, among other terms, and the companies providing coverage are also referred to (with subtle definitional differences) as plans, health plans, and carriers. We may also, at times here, use the alternate terms, interchangeably. Note particularly how a plan and a health plan can mean either the policy or the company providing the coverage, and thus care should be taken when using either term to ensure that context makes clear which is meant.

To undersrtand healthcare, we can start at the end and work backwards. People want to feel great and prevent or fix physical and mental problems. Someone wanting help with a medical condition might seek care from a doctor, hospital, specialist, or other provider, in order to feel better or to just continue feeling good. The person goes to the provider, and the provider assesses the person/patient, recommends/refers to other help, prescribes medications, equipment, or other assistive devices, gives the person instruction on what she should do to help herself, and in rare cases delivers the tough message that nothing or not much can be done to help, possibly reminding the patient to seek another professional opinion.

For the care that the providers provide, including inspections, tests, operations, prescriptions, medical equipment, etc., they incur a cost and should be fairly compensated in order to remain able to provide care to others. For all but the lowest cost care, for all but the wealthiest individuals, paying for care out of pocket is prohibitive, and if this were the only way to get care, much of what is provided to help people today would not occur. Enter health insurance.

Health insurance can be divided into what is considered mostly public and mostly private or commercial. On the public side, the cost of care is provided, in whole or in large part, by a government agency using a pool of funds collected as taxes. On the private or commercial side, the cost of care is provided, in whole or in large part, by a private business using a pool of funds collected as premium payments. There is overlap, too, such as when the patient pays for part of the care that the government mostly pays for, or as when the government subsidizes either the premium payment or cost to providers under a commercial plan.

Whether public or private insurance, the goal is the same: to collect enough money from many, many people to be able to pay for expensive care that some people actually get. This results in most people paying into the fund more than they get out in the form of care. However, what these people do get beyond their own care is the ability to use the fund in case they need it for expensive care from catastrophic occurrences, avoiding their own poor health and bankruptcy, and also, at a societal level, a healthier population resulting in less chance of being infected by others, not having to spend personal time, energy, and money to care for infirmed family members, and keeping workers on the job and productive.

How all this works for payers and members is complicated. Please contact us for help optimizing your business operations, and obtaining or maintaining a competitive advantage.